Featured Solutions

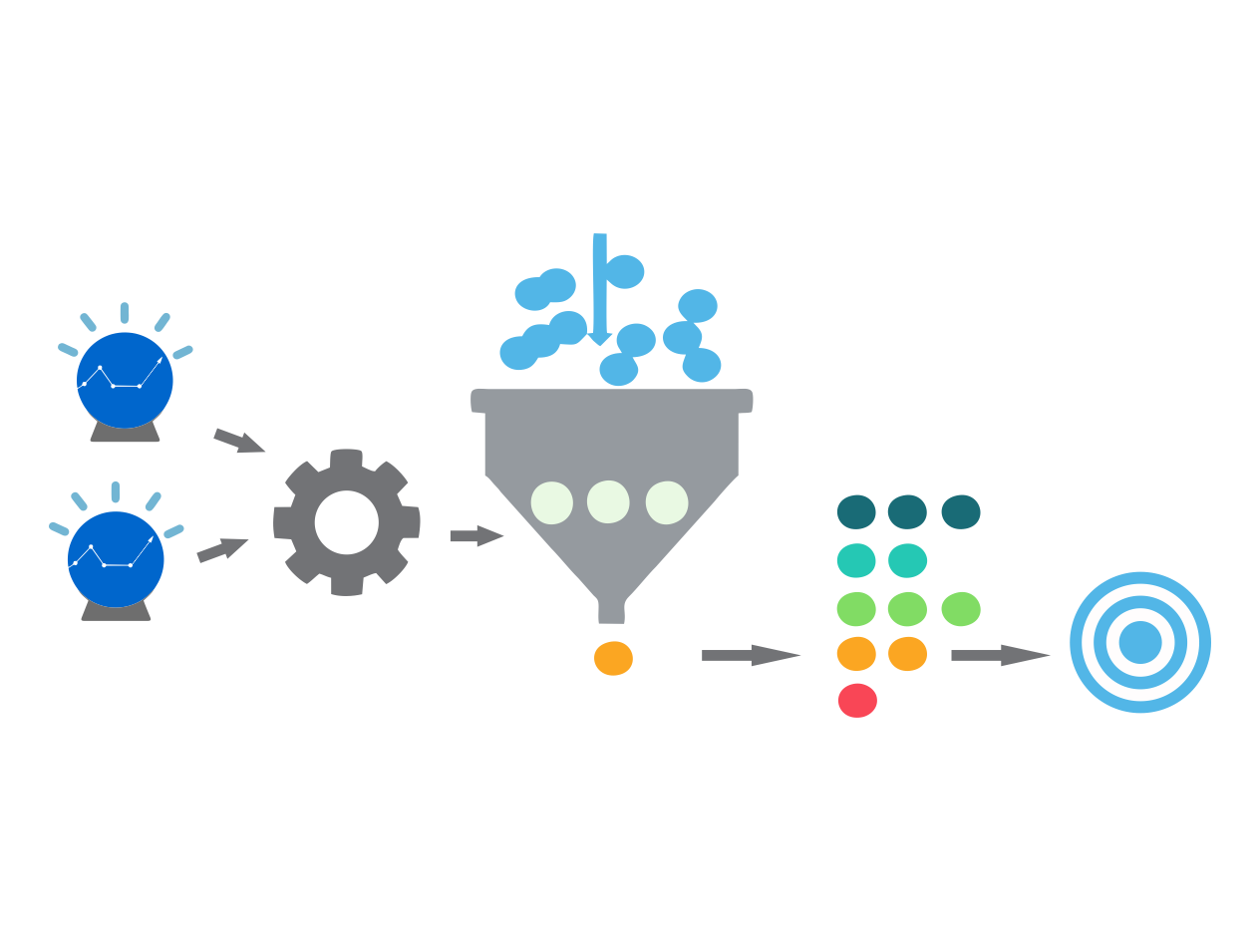

CAC, Cross Sell & Upsell

Customer Acquisition Cost (CAC) is a measure of the cost incurred to acquire new customers. One way to make a business profitable is to recover CAC at the earliest. This can be achieved through selling more products to an existing customer (Cross Sell) or selling a premium product to a customer using a cheaper product or service (Upsell). At Xtage Labs, we have developed a machine learning based approach over traditional propensity models that generate better results with improved positive response rates.

Banking on scorecards

Whether a customer is applying for a new credit card or a loan, has missed a payment or a new product is offered to prospects – the financial services business needs to know the risks. Deny a good customer and lose business. Approve a bad customer and lose money. We combine the power of traditional statistical approaches and emerging ML algorithms to develop most accurate scorecards to optimize risk and maximize profitability - Application Scorecards, Early Warning Scorecards, Roll back Scorecards, Deep Vintage Scorecards, Early Default Scorecards and others.

Better prospecting with Analytics

AI based conversational bots have emerged as an efficient option to engage with prospects and generate quality leads. Nurturing workflows can be built right into the bot to keep prospects engaged to your offerings and convert them into qualified, interested leads. Scheduling of content across time zones, geography and lead status can be automated. Our team enables proprietary as well as enterprise solutions (e.g. Dialogflow) to identify most suitable use cases and deploy an efficient chatbot for your business.

Data-driven contact center

Business growth is not driven by how many new customers you acquire, but by how many of the acquired customers you are able to retain. Contact centers are usually the first source of dealing with unhappy customers raising complaints and if done right, have a significant impact on whether a customer is going to stay when faced with servicing or any other issue. With an automated analysis of conversations, combined with insights on call volumes, frequency and duration - businesses can increase efficiency, engage and empower agents and deliver best-in-class customer experiences.

Next Best Action for Customers

At any point of time, a business has thousands of prospects (and customers) at different stage of their journeys. It is humanly impossible to process all these data and extract customers’ attributes, the sequence of their journeys and which of them purchased. Our machine learning algorithms for next best action identify the right touchpoint, the right time, the right product and the right offer – and improve the chances of conversion exponentially - with a level of accuracy and at a speed and scale that was not achievable earlier.

Predictive retention for growth

It is a cliched fact that acquiring a new customer is >10x more expensive than retaining an existing customer. As a consequence, churn prediction is one of the first analytics solution any financial services business deploys. Establishing which customers have churned is itself the most important phase – as a customer does not say when he/she is leaving. They also need to consider the dynamic behavioural patterns of financial transactions. At Xtage, we have achieved significant improvements in churn prediction accuracies by combining statistical and machine learning algorithms.

Featured Clients

Related Case Studies & Blogs

A financial services client used logistic regression based lead scoring to improve closure rates. The financial serv...

Almost all financial services (FS) have some form of social media presence. However, majority of them are not making th...

A fintech startup used deep learning based scorecard to predict future defaults at application stage. The fintech st...