A retail bank used logistic regression based scorecard to predict repayment propensity.

The retail banking client had a significant home loan exposure. The bank wanted a scorecard to predict the likelihood of an existing home loan customer making a repayment. This scorecard would use customer’s own behaviour and historical behaviour of other customers for scoring them. They wanted to determine the node points of the collection process where predictive scorecard would serve best and then, develop these scorecards and devise their implementation strategies.

Reliable. Scalable. Actionable

The key objective was to build a scorecard that is reliable. They understood that the right scorecard would allow them to help customers at risk and minimize their own losses.

- Write of losses reduced by 4.1% within 6 months of scorecard deployment

- A net revenue impact of close to USD 5 Mn.

- Insights on repayment behaviour improved loan approval process

The bank used the scorecard results to build customer personas and their risk profiles. This helped them optimize loan sizes based on the risk profile of the new home loan applicants.

Long, cumbersome & manual decision making

Banks are under increased pressure from fintech and other disruptive financial solutions to improve operational efficiencies. With the ramped up data infrastructure and investment in technology driven solutions, our client is now better placed to use advanced analytics based solutions.

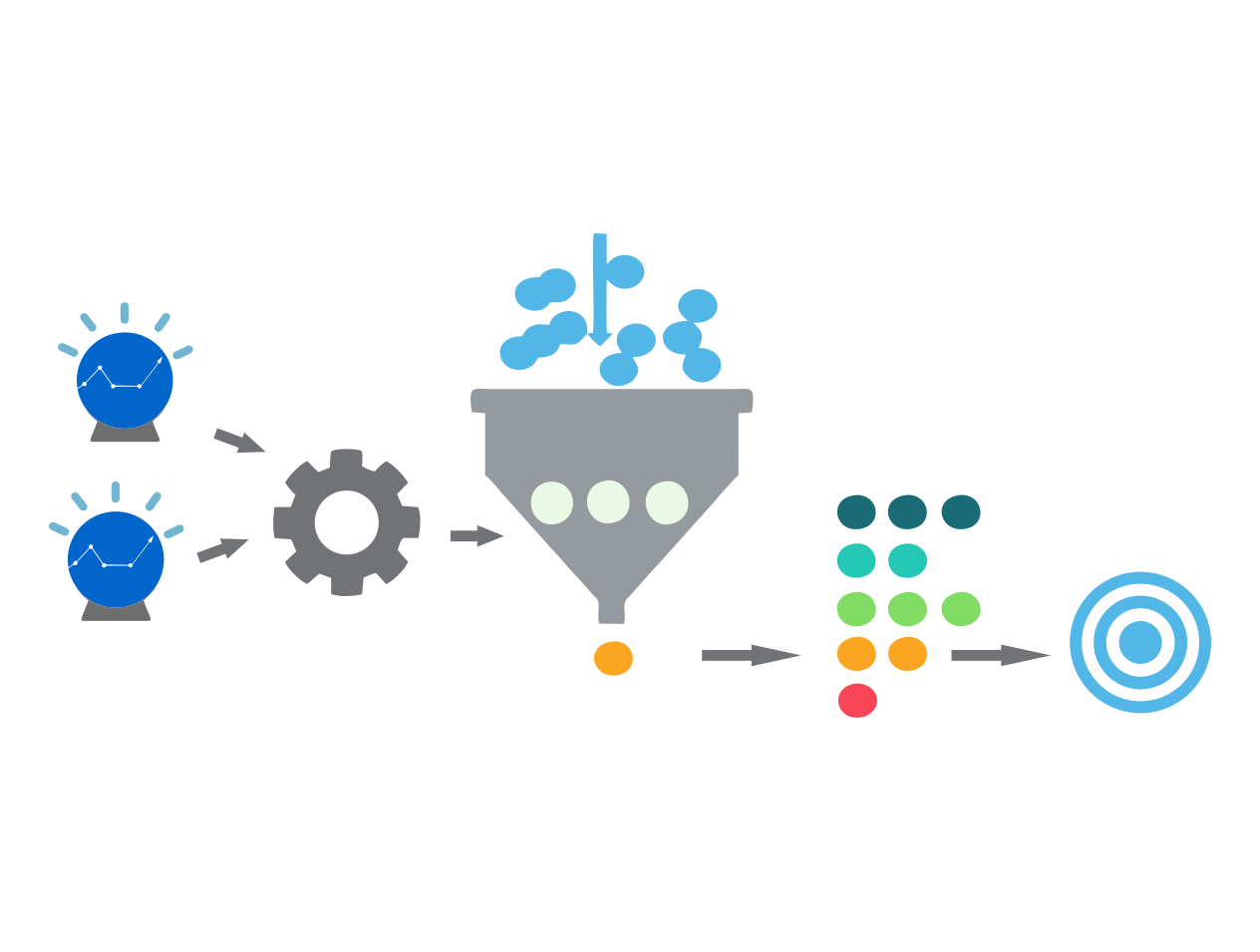

One of their key focus areas was to develop a predictive scorecard for existing home loan customers – and identify customers who posed a higher risk of default. The bank wanted to use the solution as a springboard for integrating more advanced analytics and technology driven solutions into their operations. They wanted to test if a faster home loan approval process could be developed – giving them the opportunity to leverage the existing customer relationships and taking the fight to the challengers - with a taste of their own medicine.

Scaling revenue growth with propensity modeling

The home loan scorecard solved the immediate, short-term objective of the bank in reducing write off losses. It also showed the bank develop an understanding of how advanced analytics, integrated with technology will help them fend of challenges from fintech and other disruptive competitors, including:

a. Leveraging the scorecard output to develop risk personas to improve loan approval process

b. Optimize loan sizes based on risk profiles using an advanced analytics solution

c. Reduce human involvement by eliminating manual, rule based assessments, making the process faster

The bank now has an automated decision process that is unbiased, fast, reliable and scalable.