A fintech startup used deep learning based scorecard to predict future defaults at application stage.

The fintech startup uses mobile app and web based interface to receive loan requests, collect the documents, process them and approve or reject a loan request. As a tech enabled business, their USP is convenience and speed. Given their promise of processing a loan request in 60 minutes, they were facing difficulties in processing the documents within the promised timeframe owing to larger volume of requests and the promise of convenience – hence no CPV.

Many a little makes a mickle

As the scale of operations increased, the fintech client started facing difficulties in processing of requests within 60 minutes – the primary USP of their platform

- Reduced Turn around Time (TAT) of loan processing by 80%

- Reduced defaults and non-performing loans by 3.2% for the pilot study

- Reduced dependence on credit scores and applicants with no credit history

The score predicts the likelihood of default in the next 3 months, and only the flagged cases are taken up by the underwriting team, reducing manual dependence and variability.

Low predictability of underwriting process

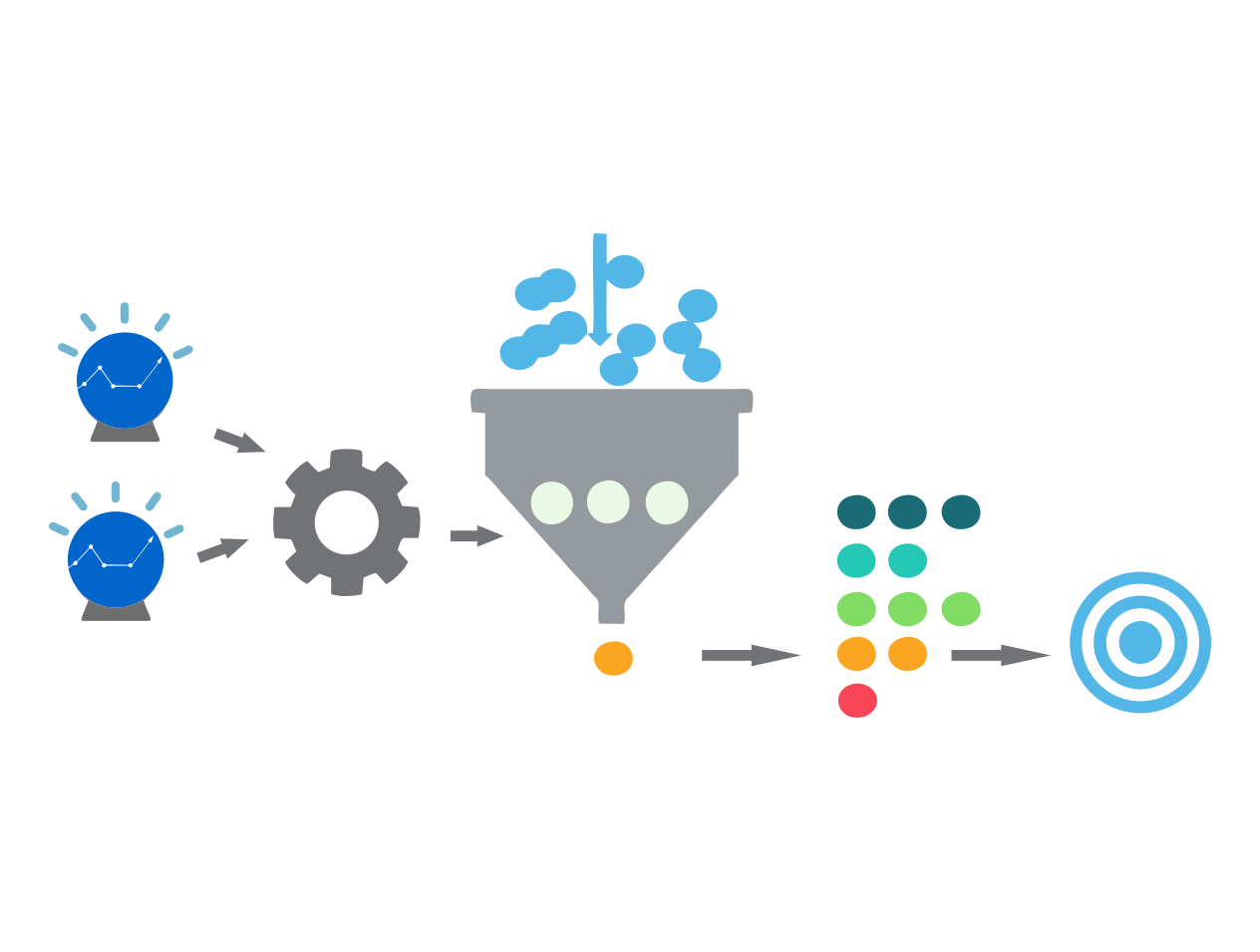

The fintech client was able to scale it’s operations through marketing activities. They had reached a scale where manual processing of loan applications were no longer feasible – owing to large volume and variability in the loan underwriting process. And since they were established on the premise of convenience and speed – turning to a technical, automated solution was the natural next step for them.

One of the challenges for implementing the machine learning based solution was the lack of sufficient data for the scorecard development – a solution that could generate future default scores based on uploaded documents – convenient enough for applicants so as not to turn them away, but good enough to generate a score that is reliable – within the promised time of 60 minutes.

Application Scoring – Fast & Easy

The deep learning based application scorecard solution fulfilled all the client requirements – fast, reliable and convenient for applicants.

With the deep learning based solution, the fintech client is able to:

a. Automate the underwriting process without manual interventions

b. Predict default propensity for applicants with no credit history

c. Integrate a solution that is scalable and not limited by the scale of opeations

The application scorecard is now used at the acquisition stage, minimizing the risk exposure and preserves the business model of our client.